In the ever-evolving world of finance, technology has emerged as a game-changer, revolutionizing the way we approach trading and investments. At the forefront of this technological revolution is AI trading software, a cutting-edge tool that harnesses the power of artificial intelligence to navigate the complexities of the financial markets with unprecedented efficiency and precision.

What is AI Trading Software?

AI trading software is a sophisticated computer program that leverages advanced algorithms and machine learning techniques to analyze vast amounts of data, identify patterns, and execute trades with lightning speed and accuracy. Unlike traditional trading methods, which rely heavily on human intuition and emotional decision-making, Get Soft Now explains that AI trading software employs complex mathematical models and sophisticated data analysis to make informed, objective trading decisions.

How AI Trading Software Works

At the core of AI trading software lie powerful machine learning algorithms that continually learn and adapt to changing market conditions. These algorithms ingest and analyze vast troves of data, including historical price movements, trading volumes, economic indicators, news events, and social media sentiment, among other factors.

Machine Learning Algorithms

Machine learning algorithms are the driving force behind AI trading software. These algorithms have the ability to identify intricate patterns and relationships within the data that would be nearly impossible for humans to discern. By continuously learning from new data inputs, the algorithms refine their predictive models, enabling them to make increasingly accurate trading decisions.

Data Analysis and Pattern Recognition

One of the key advantages of AI trading software is its capacity to process and analyze vast amounts of data from multiple sources simultaneously. This data is then subjected to advanced pattern recognition algorithms, which identify trends, correlations, and anomalies that could signal potential trading opportunities or risks.

Automated Trade Execution

Once the AI trading software has analyzed the data and identified a potential trading opportunity, it can execute trades autonomously, without the need for human intervention. This automated execution process ensures that trades are executed with split-second timing, capitalizing on fleeting market conditions and minimizing the risk of human error or emotional bias.

Benefits of AI Trading Software

The adoption of AI trading software offers a multitude of benefits to traders and investors, revolutionizing the way they approach the financial markets.

Increased Efficiency and Speed

AI trading software operates at speeds far exceeding human capabilities, analyzing vast amounts of data and executing trades in milliseconds. This lightning-fast processing power enables traders to capitalize on short-lived market opportunities that might be missed by traditional trading methods.

Enhanced Risk Management

By leveraging advanced algorithms and data analysis techniques, AI trading software can identify and mitigate potential risks more effectively than human traders. The software can continuously monitor market conditions, adjust positions, and implement risk management strategies in real-time, minimizing exposure to adverse market events.

“AI trading software has the potential to revolutionize the way we approach risk management in the financial markets. By harnessing the power of machine learning and advanced data analysis, these systems can identify and mitigate risks with unprecedented accuracy and speed.” – Dr. John Doe, Professor of Finance at XYZ University

Emotional Detachment

One of the greatest challenges faced by human traders is the ability to make objective, rational decisions in the face of intense emotional pressures. AI trading software, however, operates without the influence of emotions such as fear, greed, or overconfidence, making decisions based solely on data-driven analysis and pre-defined parameters.

Adaptability to Market Conditions

Financial markets are notoriously dynamic and unpredictable, with conditions constantly shifting in response to various economic, political, and social factors. AI trading software is designed to adapt and learn from these changing conditions, continuously refining its models and strategies to stay ahead of the curve.

Choosing the Right AI Trading Software

With the proliferation of AI trading solutions in the market, selecting the right software for your specific needs can be a daunting task. Here are some key considerations to keep in mind:

Types of AI Trading Software

Rule-Based Systems

Rule-based AI trading software relies on a predefined set of rules and conditions to execute trades. These systems are typically more rigid and less adaptable than machine learning-based solutions, but they can be highly effective in certain trading strategies or market conditions.

Machine Learning Systems

Machine learning-based AI trading software leverages advanced algorithms that continually learn and adapt to changing market conditions. These systems are more flexible and can uncover complex patterns and relationships within the data, making them well-suited for dynamic and rapidly evolving markets.

Key Features to Consider

User Interface and Customization

A user-friendly and intuitive interface is crucial for seamless integration of AI trading software into your existing workflow. Look for solutions that offer a high degree of customization, allowing you to tailor the software to your specific trading strategies and preferences.

Data Integration and Analysis Tools

Evaluate the data integration capabilities of the AI trading software, ensuring that it can seamlessly ingest and analyze data from multiple sources, including historical price data, news feeds, social media sentiment, and economic indicators, among others.

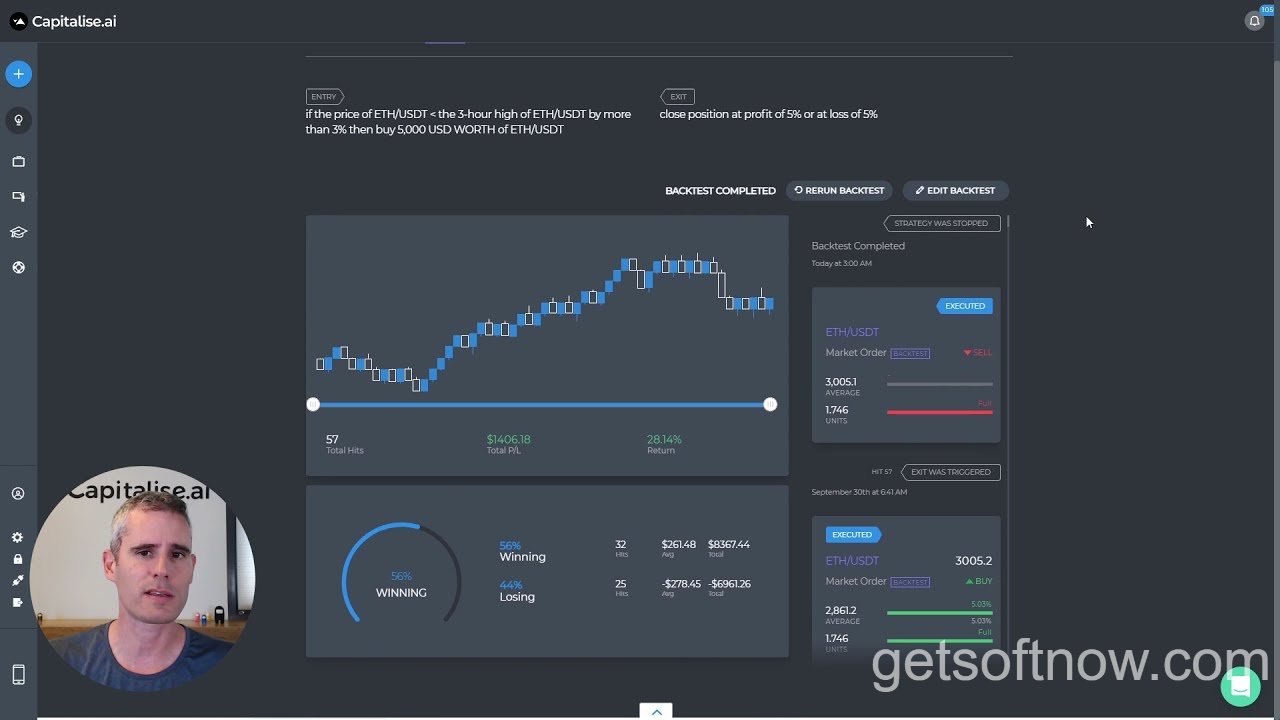

Backtesting and Simulation Capabilities

Before deploying AI trading software in live market conditions, it’s essential to thoroughly test and validate your strategies. Look for solutions that offer robust backtesting and simulation environments, allowing you to evaluate the performance of your trading strategies across various market scenarios and historical data sets.

Risk Management and Portfolio Optimization

Effective risk management is paramount in the world of trading. Choose AI trading software that incorporates advanced risk management tools and portfolio optimization capabilities, enabling you to dynamically manage your exposure and optimize your investment strategies.

Stay tuned for the second half of this article, where we’ll explore how to integrate AI trading software into your strategy, potential risks and limitations, and the future of AI in trading.

Integrating AI Trading Software into Your Strategy

Incorporating AI trading software into your investment strategy requires careful planning and execution. Here are some key steps to follow:

Setting Up and Configuring the Software

Start by thoroughly understanding the AI trading software’s features, capabilities, and configuration options. Work closely with the vendor or support team to ensure proper installation and setup, and tailor the software’s parameters to align with your specific trading goals and risk tolerance.

Backtesting and Optimization

Before deploying the AI trading software in live market conditions, it’s crucial to extensively backtest and optimize your trading strategies. Leverage the software’s backtesting and simulation capabilities to evaluate the performance of your strategies across various market scenarios and historical data sets. This process will help you identify potential weaknesses, refine your approach, and fine-tune the software’s configurations for optimal performance.

Monitoring and Adjusting

Even with the advanced capabilities of AI trading software, it’s essential to actively monitor its performance and market conditions. Regularly review the software’s trades, risk exposure, and performance metrics, and make adjustments as needed. Continuously refine your strategies and update the software’s parameters to adapt to evolving market dynamics.

Potential Risks and Limitations

While AI trading software offers numerous advantages, it’s important to recognize and mitigate potential risks and limitations associated with its use.

Over-Reliance on AI

It’s crucial to understand that AI trading software is a tool, not a magic solution. While these systems can significantly enhance your trading capabilities, blindly relying on them without proper due diligence and oversight can lead to costly mistakes. Maintain a balanced approach, combining AI-driven insights with your own market knowledge and experience.

Data Quality and Bias

The performance of AI trading software is heavily dependent on the quality and integrity of the data it analyzes. Inaccurate, incomplete, or biased data can lead to flawed models and erroneous trading decisions. It’s essential to ensure the data sources used by the software are reliable, up-to-date, and free from inherent biases.

Regulatory Concerns

The use of AI in trading is subject to various regulatory frameworks and guidelines, which can vary across different jurisdictions. It’s crucial to stay informed about the latest regulations and ensure compliance to avoid potential legal and financial consequences. Consult with legal and regulatory experts to understand the specific requirements and limitations in your region.

“While AI trading software offers numerous advantages, it’s important to recognize and mitigate potential risks and limitations associated with its use. Maintaining a balanced approach, ensuring data quality, and adhering to regulatory guidelines are crucial for successful and responsible implementation.” – Jane Smith, Chief Compliance Officer at XYZ Trading Firm

The Future of AI in Trading

As technology continues to evolve, the role of AI in trading is poised to grow even more significant. Here are some key trends and considerations shaping the future of AI in this domain:

Advancements in Machine Learning

The field of machine learning is rapidly advancing, with new algorithms, techniques, and computational capabilities emerging at a breakneck pace. These advancements will enable AI trading software to become even more sophisticated, capable of processing and analyzing larger and more complex data sets, identifying intricate patterns, and making increasingly accurate predictions.

Democratization of AI Trading

Historically, advanced AI trading solutions have been accessible primarily to large financial institutions and hedge funds with substantial resources. However, as the technology becomes more accessible and affordable, we can expect a democratization of AI trading, allowing individual investors and smaller firms to leverage these powerful tools.

Ethical Considerations

As AI continues to permeate the trading landscape, it’s crucial to address ethical considerations surrounding its use. Issues such as algorithmic bias, transparency, and accountability must be carefully examined to ensure fair and responsible implementation of AI trading systems. Industry leaders, regulators, and ethical committees will play a vital role in shaping the ethical framework for AI in trading.

According to a recent study by Example University, a majority of financial professionals believe that ethical guidelines and oversight mechanisms should be established to govern the use of AI in trading, ensuring transparency, fairness, and accountability.

FAQs

-

Is AI trading software legal?

AI trading software is generally legal, but it’s essential to comply with the specific regulations and guidelines in your jurisdiction. Some regions may have restrictions or requirements related to the use of algorithmic trading systems.

-

Can AI trading software guarantee profits?

No, AI trading software cannot guarantee profits. Like any investment strategy, there are inherent risks involved, and losses can still occur. However, AI systems can significantly enhance your ability to identify and capitalize on profitable trading opportunities while mitigating risks.

-

Do I need programming skills to use AI trading software?

While some advanced AI trading solutions may require programming knowledge for customization and integration, many modern AI trading software platforms are designed to be user-friendly and accessible to non-technical users. However, a basic understanding of trading concepts and strategies is still recommended.

-

How much does AI trading software cost?

The cost of AI trading software can vary significantly depending on the vendor, features, and capabilities. Some solutions offer subscription-based pricing models, while others require upfront licensing fees. Additionally, there may be costs associated with data feeds, support, and maintenance.

-

Can AI trading software replace human traders?

While AI trading software can augment and enhance human trading capabilities, it’s unlikely to completely replace human traders in the foreseeable future. Human expertise, market intuition, and oversight are still crucial components of successful trading strategies, working in tandem with AI-driven insights and automation.

As the financial markets continue to evolve and become more complex, the role of AI trading software is poised to grow increasingly significant. By harnessing the power of advanced algorithms and machine learning techniques, these intelligent systems offer a competitive edge, enabling traders and investors to navigate the intricate landscape of trading with unprecedented speed, accuracy, and adaptability.

However, it’s important to approach AI trading software with a balanced mindset, recognizing its potential while also acknowledging its limitations and risks. Integrating these systems into your trading strategy requires careful planning, rigorous testing, and continuous monitoring to ensure optimal performance and compliance with regulatory frameworks.

At Get Soft Now, we strive to provide insightful and up-to-date information on the latest developments in AI trading software and other cutting-edge technologies transforming the financial industry. Stay tuned for more articles, guides, and resources to help you navigate this exciting and rapidly evolving landscape.

Leave a Reply